The Icon

Technology has infiltrated all industries, few resist its lure…

— James Elliott

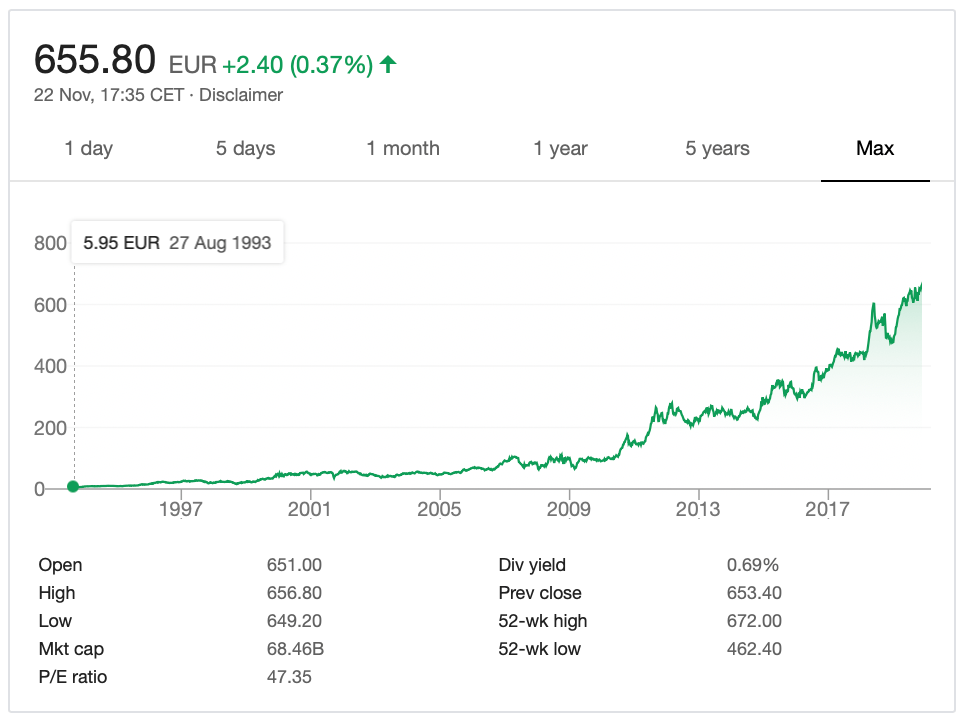

A decade of meteoric share price growth from one of the worlds oldest and most traditional brands. Technological advancement has brought with it mass production, economies of scale never thought possible and speed. It has brought Hermès a strong vertically integrated supply chain and access to clients online, but not much more. Hermès believes strongly in the hand craft techniques of its founder and is sticking with it. I like that. It appears too care little for the evolving world around it. Still it rarely advertises, no celebrity endorsements and no mass production. Still its sales rise. People often overlook the power of ‘Brand Equity’. Hermès isn’t going to dilute this. Here lies its greatest strength and asset, its traditional manufacturing technique and knowledge. Intangible, yet worth its weight in gold. Yet it faces challenges…

LMVH, Louis Vuitton, is its greatest rival. The multinational conglomerate continues to dominate the luxury goods market and enjoys wonderful share price growth, equal to that of Hermès. It has greater revenue streams and profile world wide. Should Hermès learn from its old foe?

Revenue generation is dominated by the Asia-Pacific and Japan (49%). But a continued trade war between the USA and China will shake the reliable income from the regions. Civil discourse in Hong Kong cannot help. Does it aim to reduce reliance on these regions? After all it is widely acknowledged that China’s growth is slowing. Does Hermès shift its growth strategy back to the west?

Attitudes are changing in the developed world. Ethically sourced is now a prerequisite. It is not a case for Hermès to adopt synthetics out of appeasement, this after all would dilute what Hermès stands for. But it must take a different approach to attract younger generations coming through, who’s minds are wired different to those of current, older generation customers. It uses a sustainable supply chain of cow hide, leftovers from the abattoir. It recycles its unused leathers through its subsidiary Petit H. It has voluntarily acted to reduce its carbon footprint. This is the sound the conscious need to hear. So what has Hermès got to offer the budding investor, looking to ride the luxury brand share price rise?

History and lots of it. Hermès has stayed true to its roots. It is investing heavily in acquiring new talent from french schools to join the ranks, helping provide a sustainable level of workforce to cope with product demand. It takes 6 years training to work with exotic leathers after all. This craftsmanship and detail is were the value of its products lies. The consumer knows this and is willing to wait.

Customers can wait years for a Birkin bag. Years, think about that. A business model were an individual pays an extraordinary sum for a product upfront, before it is even made, then happily waits for an undefined period of time until they receive it. Not a bad model. Few industries in todays global market would survive long if they behaved like this. Hermès is inundated with demand, linking back to the urge for craftsmanship talent.

What does the future hold? What are the opportunities?

Financial results next year will offer incite into the global financial uncertainties effect on Hermès performance. If it rides this well then continued growth is on the cards. But it must look to new markets to hedge against future turmoil financially. After all currency fluctuations hit Hermès hard as it collects revenue globally. A strong sign of leadership and direction from the company would be a look to Africa, specifically South Africa. Hermès has no presence on the continent, yet it has more billionaires than Russia, where it has physical presence. Africa is seen as politically and economically unstable but even LVMH has recognised the untapped potential. South Africa maybe flirting with an inflexion point economically, surely it’s worth a flirt with South Africa.

If Hermès looks to bring brand equity to its entire range, this should be seen as a calculated business decision by the board and family. To have its product range seek parity with their respective range leader, Hermès watches on par with Rolex, would indicate a strong belief in the brand and move some low range products into a stronger revenue generating position.

Time will tell how Hermès will fare. It has a dated business model, turned its back on the modernising technologies of the world and seeks no alignment with the image obsessed generation through endorsement. Only Hermès could make that work. So it looks like the futures bright, it looks like the future is still orange.

Verdict: Strong buy